Gambling Losses Agi

Posted : admin On 8/4/2022Because the conference agreement makes no reference to Groetzinger, it can be implied that any losses or deductions paid or incurred, up to the amount of gambling winnings, by a taxpayer classified as a professional gambler may be allowed as a “deduction for AGI,” whether or not the taxpayer itemizes deductions. If the taxpayer is instead. A taxpayer may deduct as a miscellaneous itemized deduction (not subject to the 2% of AGI limitation) gambling losses suffered in the tax year, but only to the extent of that year’s gambling gains. In other words, you can never show a net loss. The total gambling winnings are included in the adjusted gross income (AGI) for the year, and while the losses are deducted as an itemized deduction and limited to an amount not exceeding the reported winnings for the year.

The tax law allows you to deduct the amount of your gambling losses within certain limits. But these deductions are often contested in the courts.

If your AGI is over $500,000, you lose 50% of your itemized deductions (including gambling losses). You begin to lose itemized deductions at an AGI of $100,000. Ohio currently does not allow gambling losses as an itemized deduction. However, effective January 1, 2013, gambling losses will be allowed as a deduction on state income tax returns. Once you report gambling winnings, you can also then report gambling losses. Gambling losses get claimed as an itemized deduction, in section 28 in “Other Miscellaneous Deductions”. You are only allowed to claim losses up to the amount of winnings.

Salvage gambling loss deduction.

If you incur losses from gambling activities during the year, you can deduct those losses up to the amount of your winnings. Although the Tax Cuts and Jobs Act (TCJA) suspends deductions for other miscellaneous expenses from 2018 through 2025, the gambling loss deduction remains intact. Furthermore, miscellaneous expenses are deductible only to the extent that the annual total exceeds 2% of adjusted gross income (AGI). But the 2%-of-AGI floor doesn’t apply to gambling losses.

Keep detailed records.

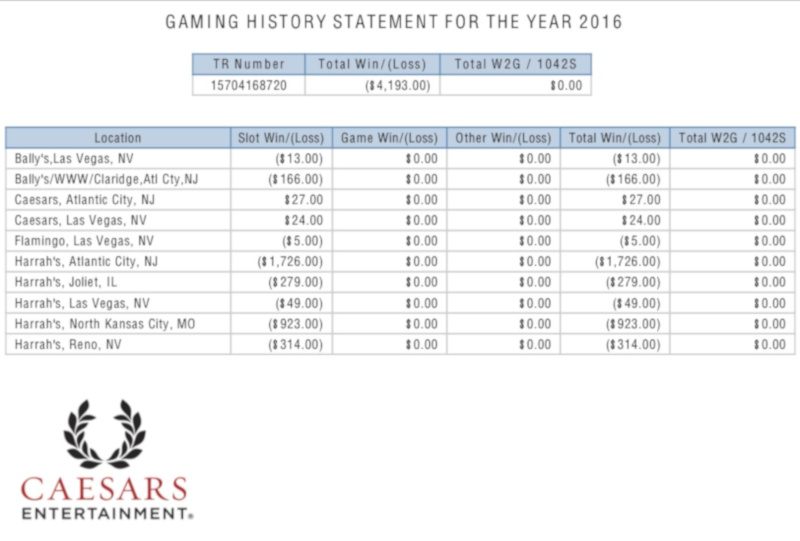

Although the tax law allows a limited deduction for gambling losses, this write-off isn’t a slam-dunk. Notably, you have to submit documentation to support your claims, including information on the dates and types of wagering activities, the names and addresses of the gambling establishments, the names of anyone who accompanied you at the activities and the amounts won or lost. Typically, you’ll have records of losing tickets, canceled checks and casino credit slips. Also, keep corroborating information (e.g., hotel bills and plane tickets.)

Going for broke.

In rate instances, a long shot for a gambling deduction may pay off. New case: An insurance consultant who was a compulsive gambler won about $350,000 during 2014, the tax year in question. But he didn’t produce documentation at trial and instead relied on the “Cohan rule” for an estimate of losses. The Tax Court judge gave credence to the testimony of a gaming expert who concluded that the taxpayer lost more than that amount. Also, the Court looked to the dire financial situation the taxpayer remained in. Result: The loss was allowed (Coleman, TC Memo 2020-146, 10/22/20).

[Note: I just realized my blog commenters are required to submit an e-mail address. Nonsense. ‘Tis no longer. Now, I simply must approve your comments before they appear. As long as it isn’t spam or obviously inappropriate, we’re cool.]

Recently, I have been preoccupied with state tax issues, and rightfully so. After all, we are anxiously awaiting New Jersey Governor Chris Cristie to sign into law legalized intrastate internet gaming. At that time, I expect us to have a much clearer picture of the law’s impact on the online poker community. In the meantime, let’s jump back to the federal side.

A quick refresher:

“Professional” gamblers report gambling winnings and gambling losses on Schedule C, Profit or Loss From Business, of the Form 1040. The resulting net winnings amount, if any, is reported on line 12 of the 1040 as business income. “Recreational” gamblers report gambling winnings on line 21 of the 1040, and report gambling losses, up to the extent of gambling winnings, as itemized deductions on Schedule A of the 1040.

I covered the primary tax implications of “professional” gamblers during my discussions of the self-employment tax and travel and entertainment expenses. Let’s turn to “recreational” gamblers.

Suppose you have a full-time job, and play online poker approximately twenty hours a week. When you file your 2010 tax return, it’s likely you report as a recreational gambler. As a diligent taxpayer does, you properly document all poker “sessions.” Your results from 2010:

Total winnings =$42,354.00. Report on line 21 of the 1040 as “Other Income.”

Total losses = $16,213.00. Report as an itemized deduction on line 28 of Schedule A.

Why are these items listed separately, and not simply netted, like they are for professional gamblers? Several reasons:

1. Itemized Deductions v. Standard Deduction

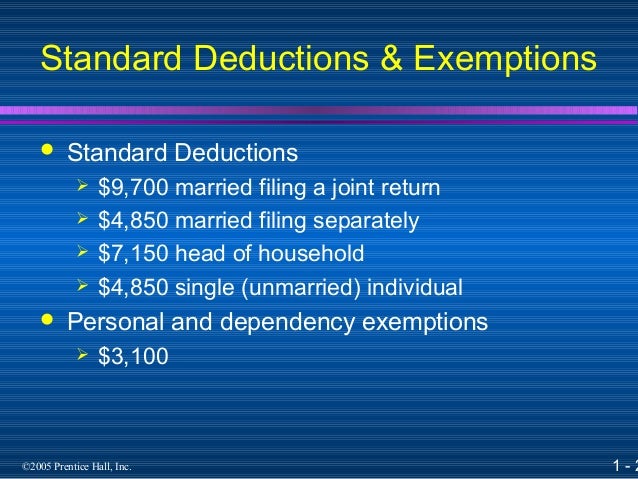

On line 40 of the 2010 Form 1040, you report either itemized deductions or your standard deduction. In general, your federal income tax will be less if you take the larger of the two. To ascertain your itemized deductions, complete Schedule A. The standard deduction is a predetermined amount based on your filing status.

Suppose the standard deduction is greater than your itemized deductions. In that case, your gambling losses are considered part of your standard deduction, and you essentially lose out on the gambling losses.

2. Adjusted Gross Income

Several tax items are tied to Adjusted Gross Income (AGI), which is listed on line 37 of the 1040. Because recreational gambling winnings are included in AGI, but gambling losses are not, the AGI amount is higher, as compared to when net gambling winnings are included in the AGI (which is the case for professional gamblers).

Deduct Gambling Losses Against Winnings

An inflated AGI can further limit a taxpayer’s ability to take other deductions. Medical expenses, an itemized deduction, can be deducted only to the extent they exceed 7.5% of the taxpayer’s AGI. For example, if a taxpayer has an AGI of $100,000, medical expenses can be deducted only to the extent they exceed $7,500. Another significant deduction tied to AGI are miscellaneous itemized deductions, which can only be deducted to the extent they exceed 2% of AGI.

3. Alternative Minimum Tax

The Alternative Minimum Tax (AMT), if applicable, requires a taxpayer to pay more in tax than he would otherwise. It was enacted to prevent taxpayers with high incomes to use so many deductions resulting in little or no tax. Indeed, the U.S. Treasury expects more and more taxpayers to be subject to AMT over the next few years.

Gambling Losses For Or From Agi

AMT is imposed on a taxpayer if the “tentative minimum tax” exceeds the regular tax, and the taxpayer then must file a Form 6251. AMT is based on a different measure of income than regular federal income tax is. This different measure is called “alternative minimum taxable income,” and includes, among other items, AGI.

In general, the greater a taxpayer’s AGI, the greater “alternative minimum taxable income” is, and accordingly, the greater is likelihood the dreaded AMT bites. All else equal, a taxpayer has a lower AGI if reporting as “professional” gambler than if reporting as a “recreational” gambler. Clearly, this result does not work in the favor of the “recreational” gambler.

Gambling Losses In Nj

Final note: Don’t conclude from this discussion that filing as a professional always generates a lower tax bill. Professional gamblers, unlike recreational gamblers, are subject to a 15.3% tax on self-employment income up to $106,800 for the 2010 tax year (note: for the 2011 tax year only, the SE tax is 13.3%). Furthermore, each taxpayer’s situation is different; whether you are a considered “professional” or “recreational” gambler under the Internal Revenue Code is a facts and circumstances determination.